| Euro rises on hopes of Greek aid package announcement

The euro extended its previous day's advance against the dollar on Friday on expectation that debt-strapped Greece might reach an agreement on its budget cuts and would receive a potential $159 billion in financial assistance.

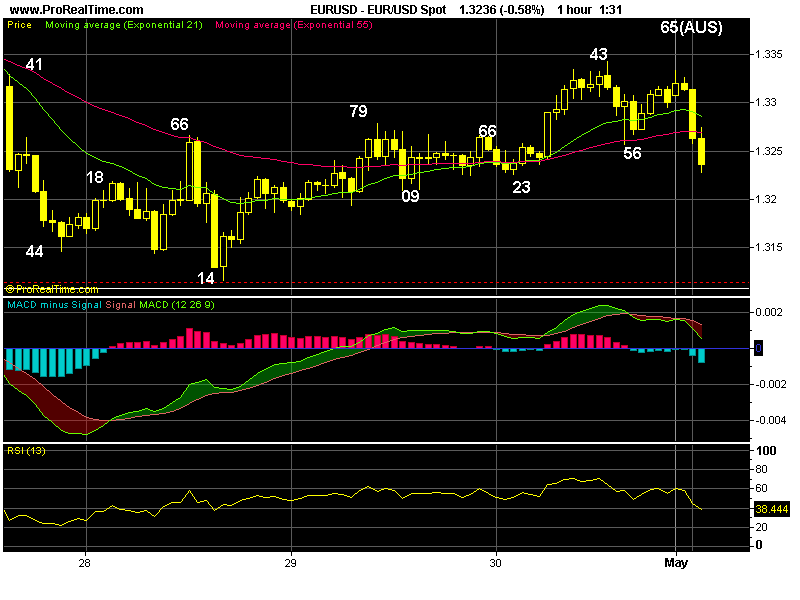

The single currency traded sideways in Asian session after Thursday's rebound to 1.3279, renewed buying at 1.3225 lifted price and the pair quickly climbed above 1.3279 at European opening. Intra-day buying gathered momentum partly on short-covering, euro subsequently rallied to as high as 1.3343 in New York before dipping briefly to 1.3255 but price rebounded on news EU finance ministers were summoned to attend a special meeting on Sunday, market speculated details of an aid package for Greece will be announced this weekend.

Versus the Japan ese yen, the greenback moved narrowly in Asia initially but then rallied to 94.59 in European afternoon after triggering stops above 94.35 and 94.45 together with active cross selling in yen. However, the pair pared all early gains later and ended the day down 0.1% from the previous close after a government report showed the U.S. economy grew at a slightly slower-than-expected pace in the first quarter. Earlier in Asian mid-day, Bank of Japan announced it had kept its overnight call rate unchanged at 0.10%. The statement of BOJ also indicated its policy board instructed staff to examine steps to support private banks on fund supplies, this would leave open the possibility that the BOJ may take steps to further bring down TIBOR, an interest rate banks use to set lending rates on corporate loans.

The British pound extended its previous day's short-covering rally as short-term speculators bought sterling after latest election poll results showed the opposition Conservat ive party had a lead after Thursday's 3rd and final televised election debate between the 3 main parties, consensus showed Tories' David Cameron put on the best performance over the Liberal Democrats' Nick Clegg and Labour's Gordon Brown. Cable rose to 1.5366 in Australia before retreating in tandem with euro to 1.5316 in Asia but renewed buying at European opening pushed price to an intra-day high of 1.5390, however, when buying fizzled out, sterling retreated sharply in New York trading to 1.5253 as short-term speculators squared their long positions ahead of a 3 day long weekend.

On the economic front, U.S. Q1 GDP rose by 3.2% (economists' forecast was 3.4%) whilst Q1 PCE price index increased by 1.5% versus the expectation of 1.6%. University of Michigan Survey's of Consumers' final April consumer sentiment fell to 72.2 (versus forecast of 71.0) from 73.6 in the March final reading. However, Chicago PMI rose in April to 63.8 (versus consensus 60.0 and 58.8 in Mar ch), which is the highest since April 2005. The eurozone March unemployment was 10.0% as widely expected whilst the April inflation estimated at 1.5% y/y versus 1.4% in March.

In other news, Switzerland’s central bank President Philipp Hildebrand stated the central bank would counter any 'excessive' appreciation of the franc against the euro, citing the debt woes across the EU zone prompted investors to shift their money into the Swiss franc.

Economic data to be released next week include: Financial markets in Japan and U.K. will be closed on Monday. Australia House price index, Swiss PMI, Germany Manufacturing PMI, EU Manufacturing PMI , U.S. PCE index, Personal income and ISM manufacturing are out on Monday, Australia RBA rate decision, Germany Retail sales, U.K. Manufacturing PMI, EU PPI , U.S. Durable goods, Pending home sales and Consumer confidence on Tuesday, U.K. N'wide Consumer Confidence, Germany Services PMI , EU Services PMI, U.K. PMI constr uction and U.S. ISM non-manufacturing on Wednesday. New Zealand Unemployment, Australia Retail sales, Australia Trade balance , Swiss CPI , U.K. Services PMI , Germany Factory orders, EU ECB rate decision, U.S. Jobless claims, Productivity, Canada Ivey PMI and Building permits on Thursday. Swiss Jobless rate,Retail sales, Retail sales, Germany Industrial production, Canada Unemployment rate, U.S. Non-farm payrolls and Unemployment rate on Friday.

|

No comments:

Post a Comment